I designed profile dashboards to help client insights and relationships, and the KYC team to perform duties.

PBWM Technology | Employee Experience Design / Data Transformation

Customer360: Comprehensive Customer Profile

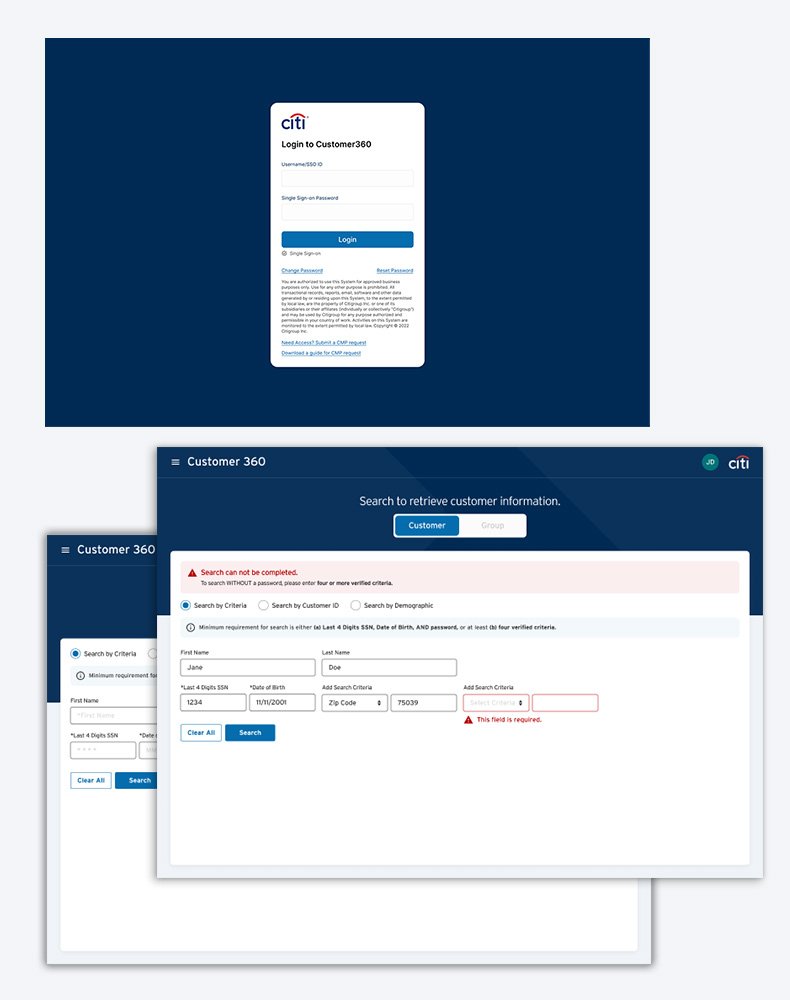

SSO Login, Profile, Search function and result criteria, strategy.

Data mapping, card sorting, UX strategy

Complete profile view and demography, accounts, products and investments.

UX/UI strategy, and prototypes

Product level relationship, profile alignment and access to KYC.

Data mapping, UX/UI strategy, prototypes

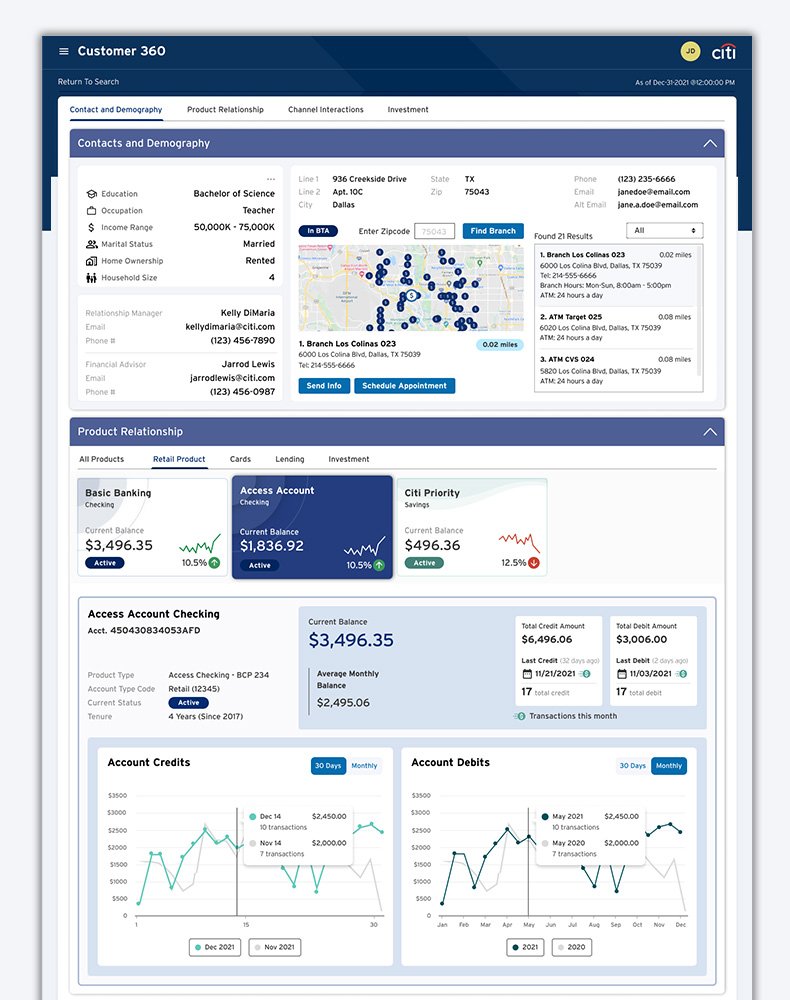

Customer360, Complete View of Customer Profile

Customer360 delivers a comprehensive, intuitive platform that consolidates a customer’s profile, household accounts, contact details, demographics, financial journey, and relationship with Citi, enhancing service quality and operational efficiency. By grouping key attributes and metrics, the dashboard provides actionable insights into transactions, spending, sentiment, pain points, and cross-channel communications, streamlining AML compliance and supporting KYC processes. Integrated with the forthcoming KYC dashboard update, Customer360 enables seamless data merging for verified profiles, improving decision-making and customer experience while ensuring regulatory adherence.

Profile Summary, Relationship and Journey Upon a successful search using account information, CIN, or household ID, the Customer360 dashboard displays the customer’s profile, essential account details, and a summary of current events, pain points, and communications. It provides insights into the client’s sentiment, relationships, and behavioral preferences

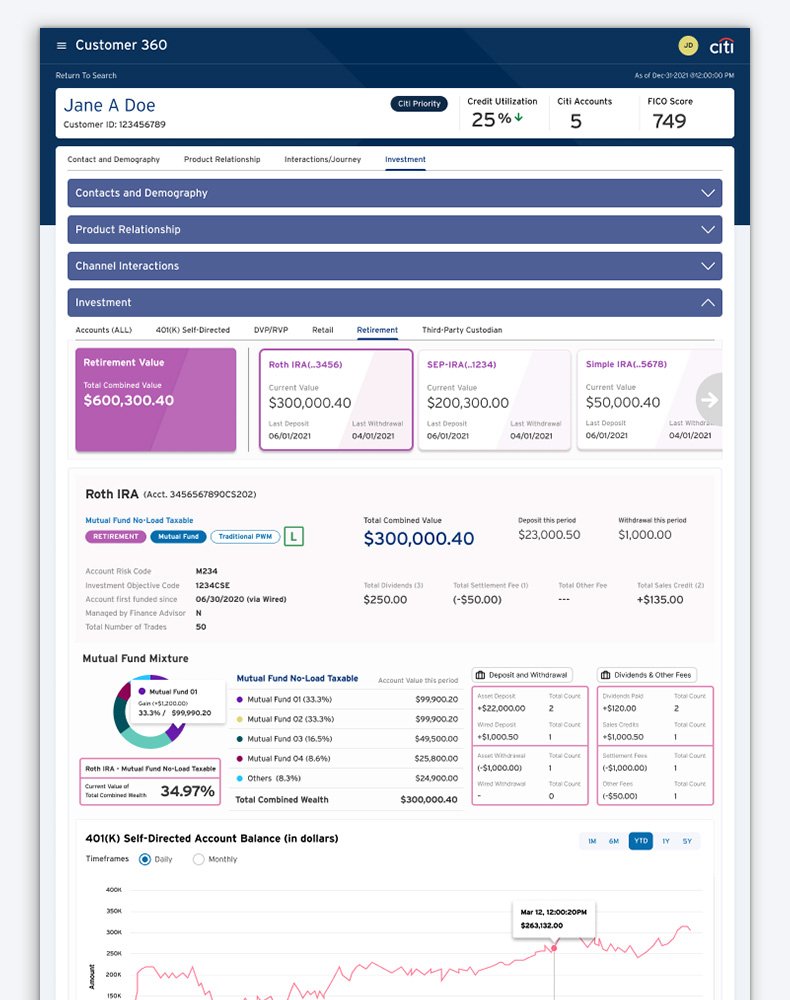

Investment Summary The Investment Summary highlights investment products, offering a detailed view for financial advisors or compliance officers to quickly assess portfolios. It integrates as a supportive tool for the AML and KYC teams, providing an additional layer of profile information and transaction verification.

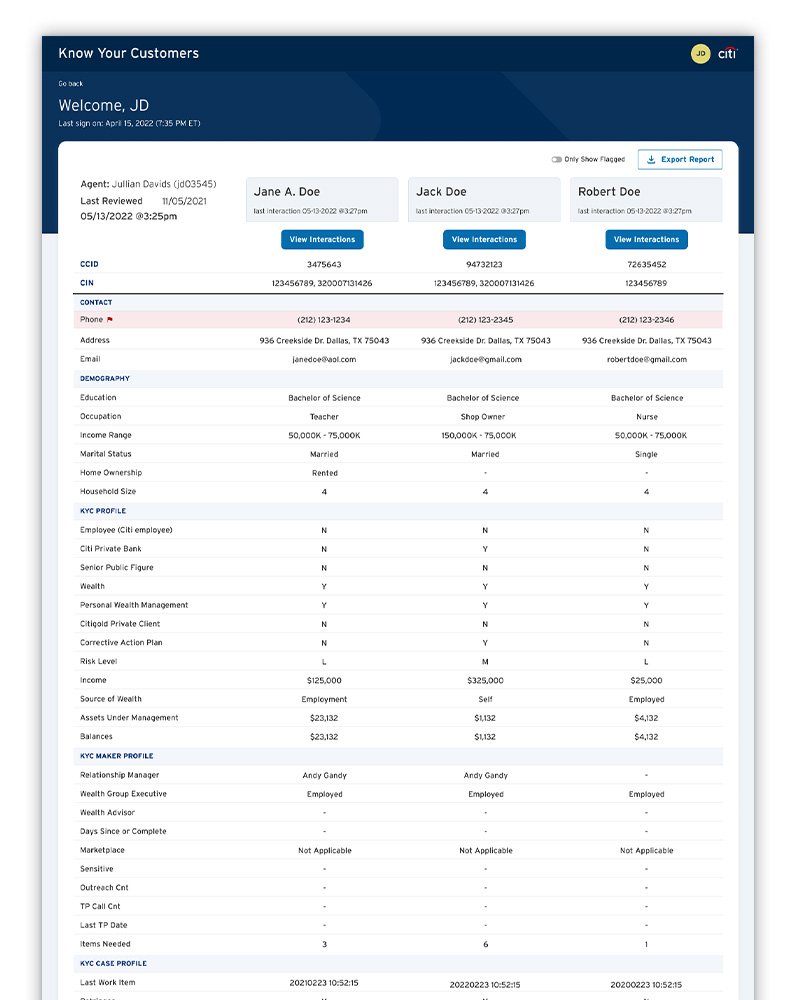

Know Your Customers (KYC) Safeguards Banking Integrity

UX/UI Strategy and research, problem analysis, data mapping, wireframe, and hi-fidelity.

KYC security Login and access, enable Search profile data align with Customer360.

Household summary quickly loads relevant data, access to customer profile.

Product and Account View displays segments associated with household and financial data.

Members under Household provides comprehensive KYC reviews at household level.

Member Profile allows 360 in-depth view, KYC compliance, and CIN account management.

KYC (Know Your Customers), an extension of Customer360, was designed under my design leadership in 2023 and 2024. Both Customer360 and KYC work together to enhance profile data quality and streamline the verification process. The system analyzes customers’ relationships with Citi and transaction data with high granularity, improving efficiency in the KYC review process. It serves as a unified repository for all profile data across product domains, businesses, and regions, ensuring customer profile data is maintained and accessible within Citi network across.

Precise Compliance Check and Individual Profile Management KYC supports the entire AML (Anti-Money Laundering) and KYC team in addressing and reviewing regulatory compliance issues. By thoroughly verifying customer profiles and transaction details, the system ensures legitimate banking activities, enhances the efficiency of compliance actions, and strengthens adherence to regulatory standards. It streamlines the KYC process by providing accurate, detailed data for swift identification of potential risks and informed decision-making.

Digitalized Process, Replacing Outdated Systems The KYC dashboard digitizes all profile data, compliance checks, and verification processes, streamlining the KYC workflow and improving accuracy. By replacing outdated manual methods and cumbersome card-based systems, it eliminates reliance on error-prone human processes and reduces the risk of mistakes, ensuring a more efficient and reliable compliance framework.